Business & Risk Management

Are you looking for a career with excellent job outlook as well as great pay? If so, there are numerous careers in the Insurance field that offer both and the Business & Risk Management program may be just for you!

Did you know that over 40% of our local insurance workforce is within 10 years of retiring? Those retirements are going to leave a huge gap in local companies who are going to need trained professionals to step in and fill these jobs. Some high demand areas include; Actuaries, Information Security Analysts, Marketing Specialists and Management Analysts just to name a few. Salary ranges in careers such as these can range from $48,000-$94,000 per year.

Insurance companies are not only looking for agents and claim adjusters, they need IT and marketing professionals, HR personnel and fraud investigators. Business and insurance careers offer great earning potential, stability in a growing industry as well as a challenging and rewarding career path. This program will allow you to explore the insurance industry through a partnership with nationally recognized AF Group.

As part of this program, you will have the option to earn three industry certifications in the areas of Property and Liability, Personal Insurance and Commercial Insurance and take pre-licensing exams. In addition, upon successful completion of this program, you can earn direct college credit with Northwood University, Olivet College or Ferris State University.

Articulated Credit

| Course | Credits |

|---|---|

| RMIN 200 (Foundations of Risk Mgmt. & Ins.) | 3 |

| RMIN 253 (Personal Insurance) | 3 |

| RMIN 252 (Commercial Insurance) | 3 |

| RMIN 305 (P/C Licensing | 3 |

| Course | Credits |

|---|---|

| BUSN 120 (Introduction to Business) | 3 |

| BUSN 210 (Professional Ethics) | 3 |

| BUSN 265 (Entrepreneurship) | 3 |

| FINC 223 (Entrepreneurial Finance) | 3 |

| FINC 230 (Financial Planning & Insurance) | 3 |

| HRMG 213 (Human Resource Management) | 3 |

| MGMT 211 (Management Foundations) | 3 |

| RMGI 221 (Principles of Risk Mgmt & Insurance) | 3 |

| RMGI 322 (Personal Insurance) | 3 |

| Course | Credits |

|---|---|

| RMIN 200 (Foundations) | 3 |

| RMIN 252 (Commercial) | 3 |

| RMIN 252 (Personal) | 3 |

| RMIN 305 (Licensing) | 3 |

The number of credits a student receives will depend on area of study, additional course requirements and meeting the minimum competency requirements at 80%. Credits earned at Ferris State University can also be used at Olivet College.

Credits are subject to change

Year 1 Program Syllabus

Our mission is to provide students with the essential knowledge, skills, and work habits to excel in their careers and future learning.

Course

Business and Risk Management (one year program with a second year option)

National Career Cluster

Finance

Michigan Career Pathway

Finance: Insurance Pathway Standards

Instructor

Monique Colizzi

Classroom: 517.244.1332

Cell: 517.202.3969

Property & Casualty Producer/Solicitor License - State of Michigan

Certified Insurance Service Representative Designation

Certified Authority on Workers' Compensation Designation

Masters in Educational Technology – Western MI University

Bachelor of Business Administration – General Business – Davenport University

Teaching Certificate – Business Administration and Speech 6-12 – Olivet College

Occupational Certificate - Business Administration Management Operations

Types of Credit

One full fourth year math credit

One full third year science credit

Michigan Merit Curriculum: Visual Performing and Applied Arts (VPAA), one full credit

World Language credit

Articulation Agreements

Ferris State University

Davenport University

Northwood University

Olivet College

Prerequisite

None. Ability to read and write at a college level highly recommended.

Fall Semester

Foundations of Insurance through InVEST insurance curriculum

Introduction to Insurance, Managing Risk, Marketing and Selling Insurance, Insurance Agency Operations, A Career in Insurance, Issues in Auto Insurance, The Personal Auto Policy, Determining the Price of Auto Insurance, Property Insurance for Homeowners and Renters, Homeowners Insurance

Personal Auto through National Alliance for Insurance Education and Research

Unit 1 – Introduction to the Personal Auto Policy Unit 2 – Policy Structure and Definitions Unit 3 – Personal Auto Policy Part A – Liability Coverage Unit 4 – Part B – Medical Payments and Part C – UM/UIM Unit 5 – Part D – Coverage For Damage To Your Auto Unit 6 – Part E – Duties After An Accident, Part F – General Provisions and Consumer Bill of Rights Unit 7 – Coverage For Car Rentals Unit 8 - Review and Certification Exam

Spring Semester

Personal Residential through National Alliance for Insurance Education and Research

Unit 1 – Introduction To Personal Residential Policies Unit 2 – Homeowners’ Policy Section I Unit 3 – Homeowners’ Policy Section II Unit 4 – Personal Umbrella, Excess Liabilities, and Hybrid Policies Unit 5 – Review and Certification Exam Unit 6 – Other Residential-Related Policies

Certified Authority on Workers’ Compensation Designation class offered through Accident Fund

- Experience Modification & Classification

- Claims

- Loss Control

- Return to Work

- Alternative Workers' Comp Programs

- United States Longshore & Harbor Workers Act

ENG 150 - First Year College Composition Grade 12 or Grade 11

- First-year College Composition – 3 hours per week for 15 weeks

- Direct Credit - Generates FSU transcript

- Part of the MTA agreement - accepted anywhere in Michigan

- Minimum GPA 2.50 / SAT Read/Write = 480 / PSAT Read/Write = 460

- No cost to local districts

- Districts can grant English 12 credit if desired

In addition to college classes through Ferris State University, students will have the opportunity for the following:

- Students will participate in case studies, off-campus trips, network with insurance professionals, be immersed in curriculum involving videos, interactive projects, quizzes, tests, be proficient in reading policies, presentations, research and putting theory into practice.

- Students will continue working toward their CISR designation by completing Personal Auto and Personal Residential. Three more classes are attached to the 2nd year of the program.

- Students will participate in at least two pitch competitions. One business and one insurance.

- Students will participate in on-campus mock interviews and be responsible for keeping their resume, portfolios and LinkedIn updated.

- Students will have the opportunity to complete a two-day class though Accident Fund for Certified Authority on Workers’ Compensation.

- Students will explore career opportunities within the insurance industry as well as post-secondary options.

- Students will have the opportunity to be part of NTHS, community service projects and other meetings and events.

Meeting Days/Times:

Monday - Friday, AM Session 8:00-10:40 am

Required Text & Materials

- ISO Form for Personal Auto and Personal Residential

- InVEST insurance curriculum or online through investprogram.org

- National Alliance for Insurance Education and Research - online course (pro.scic.com)

- For study purposes, tools for note-taking, including a notebook and index cards are recommended.

Attendance and Participation

Good attendance is required and the Wilson Talent Center’s attendance policy will be enforced. The majority of class time will be spent reading, solving case studies, working collaboratively, completing assessments, public speaking, building employability skills, and other professional projects. If you know you will be absent ahead of time, please see me in advance to make homework arrangements. It is your responsibility to find out what you missed. This should take place before the next class. You are still responsible for submitting any work that is due.

Universal Learning: The Business and Risk Management program is committed to universal learning and supporting all students’ needs. Our classroom space, routines, resources, and interactions will be as inclusive as possible. Treating each other with respect, listening to each other, having an open mind and a willingness to help each other learn is crucial to universal learning.

Course Expectations

Portfolios: Each of you will have a professional portfolio kept in the classroom. Examples of items that will be kept in your portfolio are:

- Resume & Cover Letter

- Any awards, certificates and/or letters of recommendation you received.

Submitting Work: All assignments and class announcements are housed in PowerSchool Learning. Students are expected to submit work electronically on PowerSchool Learning by the date and time noted on the assignment or through the basket in the classroom.

Late Assignments: Late work will be marked down 25% for each day that it is late. It’s important to hand in assignments on time. Computer problems are not excuses for late work. Find a solution.

Grading

Grades are based on Skill/Knowledge Attainment (for 65% of the final grade) and Work Habits (for 35% of the final grade). Skill/Knowledge Attainment consists of the following:

- Tests and Quizzes: 20%

- Activities/Assignments: 15%

- Projects: 30%

- Work Habits: 35%

Work Habits are the ways in which a worker goes about doing a job. Developing excellent Work Habits is as important as developing excellent knowledge and job skills, thus these are included as part of each student’s class grade. The ten (10) Work Habits evaluated are listed as follows:

| Rating | Grade | Attendance/ Participation for Excused Absences | Description |

|---|---|---|---|

| 5 - Exceptional | 100% A | 0 - 2 | Student always satisfies work habit indicators. student exceeds work habits standards when possible. |

| 4 - Acceptable for Employment | 87% B+ | 3 | Student satisfies work habit indicators a large majority of the time. student is ready for job placement. |

| 3 - Acceptable for Classroom | 75% C | 4 | Student usually satisfies work habit indicators. Student is not ready for job placement. |

| 2 - Not Acceptable for Classroom | 55% E | 5 | Student satisfies the work habit indicators less than half of the time. Student's work habits need great improvement in order to continue at the Talent Center. |

| 1 - Not Acceptable fro WTC | 0% E | 6+ | Student rarely satisfies the work habit indicators. Student's work habits need great improvement in order to continue at the Talent Center. |

Attendance work habit: Students may have up to two excused absences each six-week marking period without it affecting their work habits grade.

All written work and participation receives point scores, and your percentage of total points determines your course grade. There is no extra-credit or make-up work, so put full effort into the regular assignments.

93-100% = A

90-92% = A-

87-89% = B+

83-86% = B

80-82% = B-

77-79% = C+

73-76% = C

70-72% = C-

67-69% = D+

63-66% = D

60-62% = D-

0-59% = E

* Final Note: Instructor reserves the right to make any needed and appropriate adjustments to the syllabus.

Year 2 Program Syllabus

Our mission is to provide students with the essential knowledge, skills, and work habits to excel in their careers and future learning.

Course

Business and Risk Management (one year program with a second year option)

National Career Cluster

Finance

Michigan Career Pathway

Finance: Insurance Pathway Standards

Instructor

Monique Colizzi

Classroom: 517.244.1332

Cell: 517.202.3969

Property & Casualty Producer/Solicitor License - State of Michigan

Certified Insurance Service Representative Designation

Certified Authority on Workers' Compensation Designation

Masters in Educational Technology – Western MI University

Bachelor of Business Administration – General Business – Davenport University

Teaching Certificate – Business Administration and Speech 6-12 – Olivet College

Occupational Certificate - Business Administration Management Operations

Types of Credit

One full fourth year math credit

One full third year science credit

Michigan Merit Curriculum: Visual Performing and Applied Arts (VPAA), one full credit

World Language credit

Articulation Agreements

Ferris State University

Davenport University

Northwood University

Olivet College

Prerequisite

Successful completion of Business & Risk Management Year 1.

Fall Semester

Commercial Casualty through National Alliance for Insurance Education and Research

Unit 1 – Fundamentals of Commercial Property Insurance Unit 2 – Sources and Trigger of Liability Unit 3 – Coverages and Exclusions Unit 4 – Medical Payments and Who is “Insured?” Unit 5 – Introduction to the Business Auto Policy Unit 6 – Practice Exam, Review, and Certification Exam

Elements of Risk Management through National Alliance for Insurance Education and Research

Unit 1 – Introduction to Risk Management Unit 2 – Risk Identification Unit 3 – Risk Analysis Unit 4 – Risk Control Unit 5 – Risk Financing Unit 6 – Risk Administration Unit 7 – Practice Exam, Review, and Certification Exam

TestOut – Office Pro Certification online

Microsoft Word, Microsoft PowerPoint, Microsoft Excel, Certification Exam

Teaching Methods:

All material will be distributed via TestOut. class notes, instructional materials

Spring Semester

Life and Health through National Alliance for Insurance Education and Research

- Unit 1 – Introduction to Life Insurance

- Unit 2 – Types of Life Insurance

- Unit 3 – The Life Insurance Policy

- Unit 4 – Application of Insurance Products

- Unit 5 – Annuities

- Unit 6 – The Health Insurance Environment

- Unit 7 – Introduction to Health Insurance

- Unit 8 – Medicare/Medicaid

- Unit 9 – Practice Exam, Review, and Certification Exam

Certified Authority on Workers’ Compensation Designation class offered through Accident Fund

- Experience Modification & Classification

- Claims

- Loss Control

- Return to Work

- Alternative Workers' Comp Programs

- United States Longshore & Harbor Workers Act

Two-day course with a 75 question designation test. Needed to pass is a 70%

RMIN 305 - Insurance Licensing

Course Description:

RMIN 305 This course prepares students to take the state exam for P/C Producer/Solicitor’s license. Upon successful completion of this course and passing a final exam of 100 questions with 80% and a practice exam of 256 question test with a 73%, students who are 18 years of age will be eligible to take the P/C Producer/Solicitor State Exam through PSI Testing Center in Holt, MI.

Students will use course materials from Michigan School of Insurance curriculum to study from and prepare for the state exam. Students will also use study materials from National Alliance for Insurance Education and Research.

Course Outcomes

Students will pass with an 80% or better, quizzes from all units listed below.

Students will understand and answer with proficiency the following concepts:

- General Insurance (56 questions)

- Homeowners and dwelling (47 questions)

- Personal auto (21 questions)

- No-fault auto (10 questions)

- State law for P&C specific (13 questions)

- General state law (31 questions)

- Commercial Package Policy (42 questions)

- Commercial Auto (8 questions)

- Worker’s Comp (17 questions)

- Business Owners Policy and Miscellaneous (28 questions)

Grade 12

ENG 150 - First Year College Composition

- First-year College Composition – 3 hours per week for 15 weeks

- Direct Credit - Generates FSU transcript

- Part of the MTA agreement - accepted anywhere in Michigan

- Minimum GPA 2.50 / SAT Read/Write = 480 / PSAT Read/Write = 460

- No cost to local districts

- Districts can grant English 12 credit if desired

In addition to college classes through Ferris State University, students will have the opportunity for the following:

- Students will participate in case studies, off-campus trips, network with insurance professionals, be immersed in curriculum involving videos, interactive projects, quizzes, tests, be proficient in reading policies, presentations, research and putting theory into practice.

- Students will continue working toward their CISR designation by completing Commercial Casualty Life/Health and Elements of Risk Management.

- Students will participate in an 6-month Insurance BFF Mentor Program with a professional from the insurance industry.

- Students will have the opportunity to attend a week-long trip through CloseUp®, to Washington DC (restrictions and requirements apply to be eligible).

- Students will participate in on-campus mock interviews and be responsible for keeping their resume, portfolios and LinkedIn updated.

- Students will have the opportunity to complete a three-day class though Accident Fund for Certified Authority on Workers’ Compensation.

- Students will have the opportunity to host an insurance convention and participate in other major projects.

- Students will explore career opportunities within the insurance industry as well as post-secondary options.

- Students will have the opportunity to be part of NTHS, community service projects and other meetings and events.

Meeting Days/Times

Monday - Friday, PM Session, 11:35 am - 2:15 pm

Required Text and Materials

- ISO Forms for CP

- National Alliance for Insurance Education and Research - Commercial Casualty, Life/Health and Elements of Risk Management - online course (pro.scic.com)

- For study purposes, tools for note-taking, including a notebook and index cards are recommended.

Attendance & Participation

Good attendance is required and the Wilson Talent Center’s attendance policy will be enforced. The majority of class time will be spent reading and discussing the textbook as a large group or in smaller teams, building employability skills, professional development and projects. An excused absence is one that can’t be helped. For example, you are very sick or you are involved in another academic activity at your home school that day. If you know you will be absent ahead of time, please see me in advance to make homework arrangements. It is your responsibility to find out what you missed. This should take place before the next class. You are still responsible

for submitting any work that is due.

Course Expectations

Portfolios

Each of you will have a professional portfolio kept in the classroom. Examples of items that will be kept in your portfolio are:

- Resume & Cover Letter

- Quality Work

- Any awards, certificates and/or letters of recommendation you may receive throughout the course of the year.

Submitting Work

Students are expected to submit work on time, as indicated by instructor. Sometimes it may be electronically; other times it may be printed and turned into class basket.

Universal Learning

The Business & Risk Management program is committed to universal learning and supporting all students’ needs. Our classroom space, routines, resources, and interactions will be as inclusive as possible. Treating each other with respect, listening to each other, having an open mind and a willingness to help each other learn is crucial to universal

learning.

Late Assignments

Late work will be marked down 25% for each day that it is late. It’s important to hand in assignments on time. Computer problems are not excuses for late work. Find a solution to your technology problem: use a friend’s computer, use the school’s facilities, and plan

ahead. It is in your best interest to save an electronic copy of your work in multiple locations.

Grading

Grades are based on Skill/Knowledge Attainment (for 65% of the final grade) and Work Habits (for 35% of the final grade). Skill/Knowledge Attainment consists of the following:

• Tests and Quizzes: (20%)

• Activities/Assignments: (15%)

• Projects: (30%)

• Work Habits: (35%)

Work Habits are the ways in which a worker goes about doing a job. Developing excellent Work Habits is as important as developing excellent knowledge and job skills, thus these are included as part of each student’s class grade. The ten (10) Work Habits evaluated are listed as follows:

| Rating | Grade | Attendance/ Participation for Excused Absences | Description |

|---|---|---|---|

| 5 - Exceptional | 100% A | 0 - 2 | Student always satisfies work habit indicators. student exceeds work habits standards when possible. |

| 4 - Acceptable for Employment | 87% B+ | 3 | Student satisfies work habit indicators a large majority of the time. student is ready for job placement. |

| 3 - Acceptable for Classroom | 75% C | 4 | Student usually satisfies work habit indicators. Student is not ready for job placement. |

| 2 - Not Acceptable for Classroom | 55% E | 5 | Student satisfies the work habit indicators less than half of the time. Student's work habits need great improvement in order to continue at the Talent Center. |

| 1 - Not Acceptable fro WTC | 0% E | 6+ | Student rarely satisfies the work habit indicators. Student's work habits need great improvement in order to continue at the Talent Center. |

ATTENDANCE WORK HABIT

Students may have up to two excused absences each six-week marking period without it affecting their work habits grade.

All written work and participation receives point scores, and your percentage of total points determines your course grade. There is no extra-credit or make-up work, so put full effort into the regular assignments.

93-100% = A

90-92% = A-

87-89% = B+

83-86% = B

80-82% = B-

77-79% = C+

73-76% = C

70-72% = C-

67-69% = D+

63-66% = D

60-62% = D-

0-59% = E

Final Note

Instructor reserves the right to make any needed and appropriate adjustments to the syllabus.

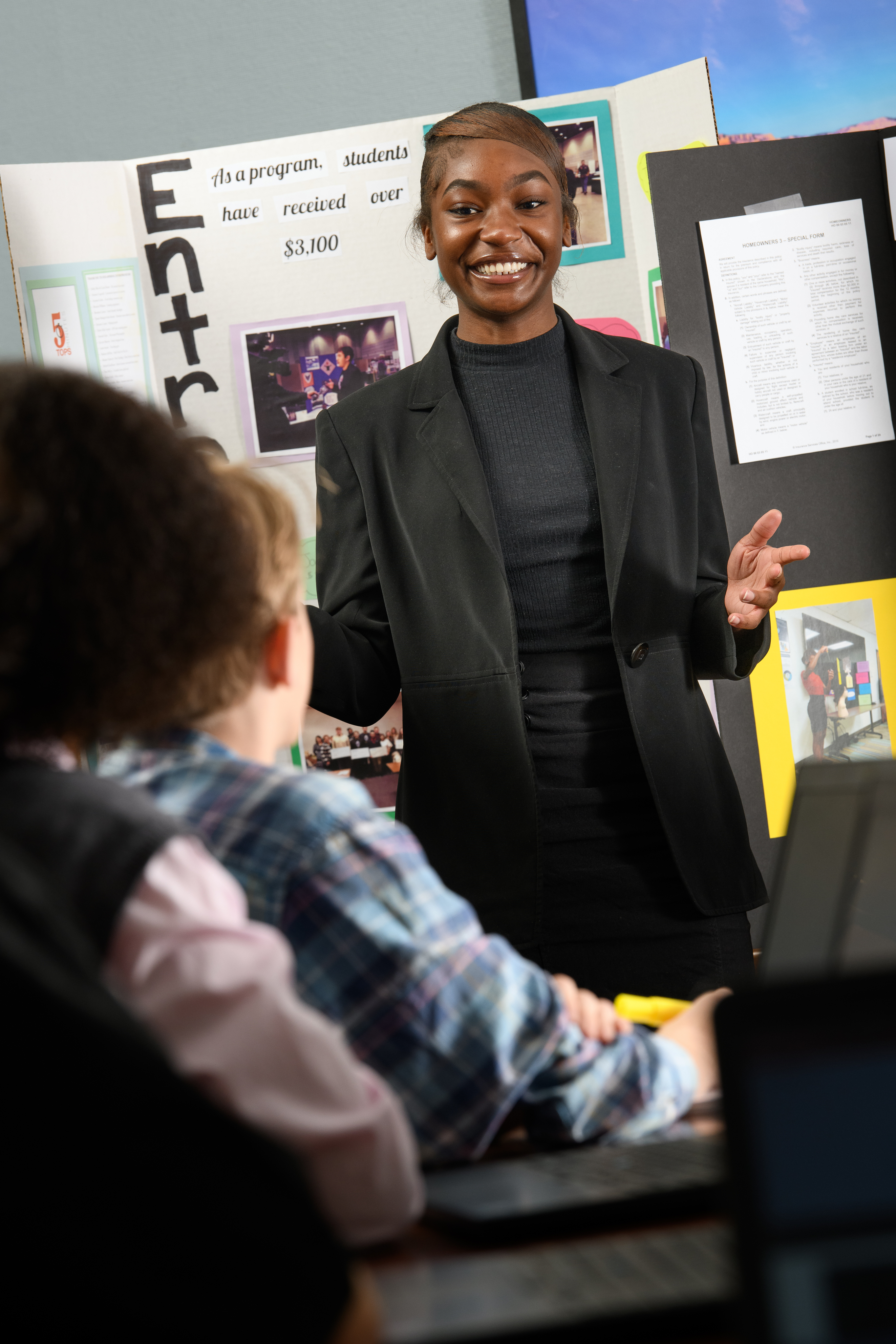

Photos from the Business & Risk Management program . . .

-

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

-

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

-

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

-

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

-

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

-

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

-

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

Click to see a larger version

Skip to end of gallery

Skip to start of gallery

Business & Risk Management Program Virtual Tour

Student Testimonials

The following music was used for this media project:

Music: New Academic Year by WinnieTheMoog

Free download: https://filmmusic.io/song/9773-new-academic-year

License (CC BY 4.0): https://filmmusic.io/standard-license

About Business & Risk Management

1-2 year program

1st year students attend in the AM

2nd year students attend in the PM

Skills Students Leave With:

Areas of Insurance

Collaboration

Marketing

Teamwork

Communication